🌊The Fintech Wave #62

TLDR: Earning reports from Facebook, SNAP, and Peloton; check bank stocks that pay dividends, UK has a new neobank unicorn; Stripe is raising $3B for the new round.

Bank stocks that pay dividends

If you are looking to invest in some bank’s stocks, you might also pick bank stocks that pay dividends. Some of them pay more than 4% per year, so below are some ideas👇

Earning reports📈

Similar to the previous week, A lot of companies published quarterly results last week, so we are bringing you the summary for some of them to give you a couple of ideas for investments.

Meta stock is 30% up after earning report🚀

Facebook's parent company Meta has a great quarter compared to Q3 earlier this year. The biggest problem before was zero control on the cost side. After layoffs and some restructuring, looks like Meta’s cost controls are getting better and investors are optimistic for the year ahead.

Also, you can hear people talking that nobody uses Facebook anymore. Based on earning reports this is simply not true - Facebook has 2 Billion daily active users. No other social network comes even close to that.

Revenue $32.1B (vs $31.5B estimate)

2 Billion DAU (Daily Active Users)

Free Cash Flow is up 2960% Q over Q (from $173M to $5.2B)

OpEx for 2023 is lowered from $97B to $92B

On the other hand, SNAP stock sharply fell📉

Almost no revenue growth in Q4 for Snap📷. Looks like the company has its peak during Covid and is not struggling to grow. Daily active users grew 17% (375 million) globally, but in the USA the growth was only 3%. Operating costs vare still too high, even after the layoffs.

Revenue $1.9B (0% growth YoY)

Net loss for Q4 is $288M (last year the company had a net profit in Q4)

Revenue per user is down 15% in FY22 - they will have to figure out new ways of monetization

The stock fell below $10 in the after-hours trading. At an all-time high, it was above $83.

Peloton is trying to turn the ship around

Peloton was one of the stocks that has unreal growth during the pandemic because everybody was doing training at home. After the pandemic was over there was no more growth and the stock lost more than 90% from its all-time high. But now after new earning reports, the stock is up 33%, because Peloton is cutting costs (mostly with layoffs) - from 9,000 employees to 4,000

87% growth in revenue Q over Q ($381.4 vs $204.2).

The number of subscribers stayed flat at 6.7M.

Net loss is at ($335.4M) which is 24% better than at the same time last year. Peloton could turn this around.

In Q2 results, Peloton published that the company has an $8M positive cash flow if they exclude payments to suppliers. Really creative way to explain financial results😂

This reminds me of WeWork, which has “Community Adjusted EBITDA” for years in its reports. Nobody ever saw that term before, but it helped WeWork to show better results.

European News and Funding

New UK-based Unicorn bank🦄

Neobank Zopa just raised $93M and achieve unicorn status. Neobanks are especially hit hard by increasing interest rates, but Zopa claims that its revenue grew more than 100% YoY and it plans to become profitable in 2023.

Zopa is the poster child of how neobanks should do business because it offers savings accounts, credit cards, and all kinds of lending services with attracted more than 850.000 customers. Also, the company issued more than 400.000 credit cards.

Worth to mention that Zopa is the “real” bank with its own banking licenses from UK authorities. All in all, one of the most successful fintech stories in Europe.

Americas News and Funding

$1B investment into Stripe💰

Looks like Stripe is going to raise one more private round before going on IPO. Thrive Capital committed to invest $1B at a $60B valuation, while Stripe is looking to raise up to $3B in total. One of the reasons Stripe is raising money is to buy back stocks from the employees. A lot of employees will become millionaires after this.

Since the company is private we don’t know if they are profitable, although Stripe claims it is.

Some people are asking why Stripe is even raising money because in total the company already raised $2.2B in 21 rounds.

Tweets and Threads of the Week

Nothing beats infinite American optimism👇

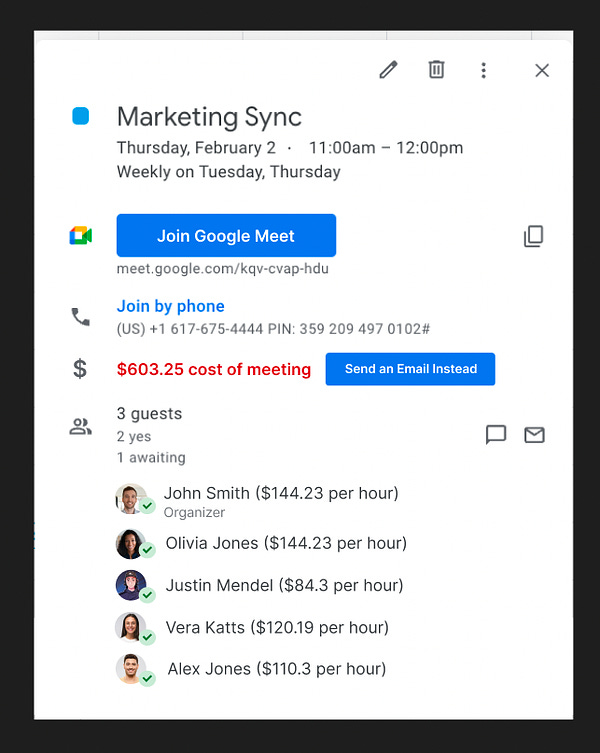

Imagine if the meeting invite shows the cost of the meeting👇

The best home office view 👇

This could really happen soon👇